PRIVACY POLICY

Privacy Policy for ESOP Help

Effective Date: Nov 21, 2024

At ESOP Help, we are committed to protecting your privacy. This Privacy Policy explains how we collect, use, and safeguard your information when you engage with our lead generation services, including interactions through Facebook ads. By providing your information to us, you consent to the practices described below.

Information We Collect

We may collect the following types of information when you interact with our Facebook ads or fill out our forms:

• Personal Information: Such as your name, email address, phone number, and business-related information (e.g., company name, size, and revenue) that you provide when you complete a form or inquiry.

• Usage Data: Non-identifiable information such as your interactions with our ads, browser type, IP address, and other analytics data collected by Facebook and other platforms.

How We Use Your Information

We collect and use your information for the following purposes:

1. To assess your business’s eligibility for the services we offer, such as ESOP consultation or related services.

2. To contact you regarding the information, services, or offers you expressed interest in.

3. To improve our marketing campaigns, including tailoring ads to better suit your preferences.

4. To send periodic emails or messages about relevant services, offers, or updates (if you’ve opted in to receive communications).

We do not sell your personal information to third parties.

How Your Information Is Protected

We take appropriate technical and organizational measures to safeguard your personal information, including:

• Storing your data on secure servers.

• Limiting access to personal information to authorized personnel only.

• Using encryption, firewalls, and other security measures to prevent unauthorized access.

However, no method of data transmission or storage is 100% secure, so we cannot guarantee absolute security.

Third-Party Sharing

We may share your information with third parties in the following situations:

• Service Providers: We may work with vendors who assist us with advertising, analytics, or customer service. These vendors are contractually obligated to protect your information.

• Compliance with Laws: If required by law, we may disclose your information to regulatory authorities or law enforcement.

Your Rights

You have the right to:

• Request access to the personal data we collect about you.

• Request corrections or updates to your personal data.

• Request that we delete your personal data, subject to legal obligations.

To exercise these rights, please contact us at [email protected].

Cookies and Tracking

We may use cookies, pixels, and similar tracking technologies provided by Facebook and other platforms to enhance our advertising and understand user behavior. These tools help us deliver relevant ads and analyze campaign performance.

Children’s Privacy

Our services are not intended for individuals under the age of 18. We do not knowingly collect personal information from children.

Changes to This Policy

We may update this Privacy Policy from time to time to reflect changes in our practices or applicable laws. Any changes will be posted on this page with an updated effective date.

Contact Us

If you have any questions or concerns about this Privacy Policy or how we handle your personal information, please contact us at:

ESOP Help

4609 Aukai ave, Honolulu, HI 96816

This Privacy Policy complies with Facebook’s advertising policies and applicable data protection laws, ensuring transparency and trust in how we handle your information.

STARTING AT $1/DAY

Life insurance

that makes sense

Ian is an average guy just like you and me,

so when he heard that he should have life insurance, he was skeptical. Now Ian makes life insurance easy for the average Canadian to get the coverage they need at a price that makes sense.

PROTECT YOUR FAMILY

Affordable coverage

About 70% of Canadians overestimate the price of life insurance, but it’s not their fault! Life Insurance is vague and confusing, and Ian is here to fix that by getting Canadians with the right policy for their situation, and it all starts as low as $30/month.

PROTECT YOUR FAMILY

Affordable

coverage

About 70% of Canadians overestimate the price of life insurance, but it’s not their fault! Life Insurance is vague and confusing, and Ian is here to fix that by getting Canadians with the right policy for their situation, and it all starts as low as $30/month.

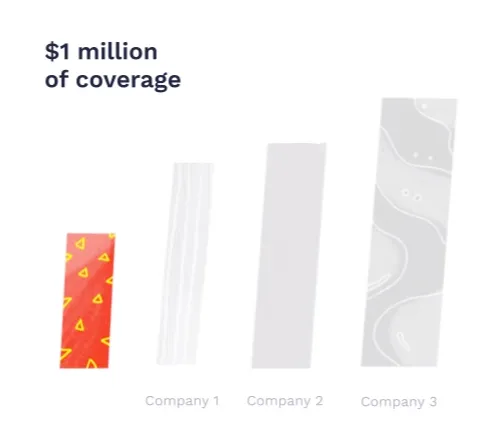

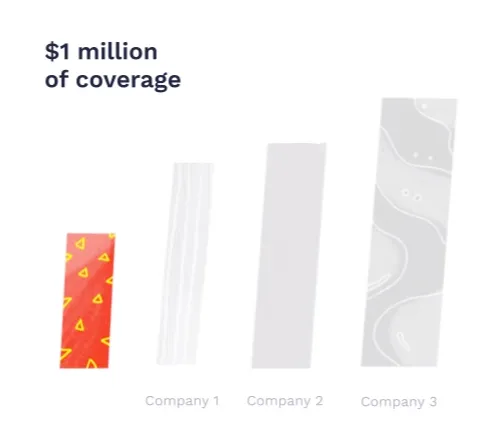

MORE FOR LESS

Why Choose an ESOP?

An Employee Stock Ownership Plan (ESOP) transforms employees into stakeholders, boosting morale and productivity. ESOPs offer tax advantages, improve employee retention, and provide a sustainable succession plan, ensuring your company’s longevity.

MORE FOR LESS

Why do people get

life insurance?

Life insurance is a way to make sure that your family and dependants don’t suffer financially when you pass. Life insurance can be used to pay for a funeral, pay off debts (including your mortgage), pay for your children’s education and help your family maintain their standard of living when they no longer have you to support them.

ONLY RECOMMEND CERTIFIED PARTNERS

You're in good hands

Connect with professionals who are certified and highly experienced in ESOP planning and implementation.

Highly Rated

Work with top-rated experts trusted by businesses nationwide for successful ESOP transitions.

In-Depth Review

Receive tailored guidance to match your unique business needs and goals.

In-Depth Review

All of our Life Insurance partners are vetted to ensure they are properly certified and licensed.

ONLY RECOMMEND CERTIFIED PARTNERS

You're in good

hands

All our insurance partners are vetted and reviewed by Ians team to ensure they hold up to our standards.`

Highly Rated

All our life insurance providers have hundreds of 5 star reviews.

In-Depth Review

When you contact Ian we will do an in depth review of our database to find the perfect partner for you.

In-Depth Review

All of our Life Insurance partners are vetted to ensure they are properly certified and licensed.

So, how does it work?

Take assessment

Complete our quick assessment to see if you qualify and help us understand your objectives.

Get matched with experts

We connect you with certified partners best suited to guide your ESOP journey.

Get the perfect fit

Collaborate with your matched expert to design and implement a custom ESOP solution.

HOW IT WORKS

So, how does it

work?

Fill out the form or take our assessment and Ian will automatically search his database of certified life insurance partners to find the perfect option for your situation.

Take assessment

Our life insurance assessment will help us recommend the right partner for you (not all life insurance works for everyone!)

Ian will find your match

Based on your answers Ian will determine if you qualify and match with one of our partners.

Get the perfect policy

Ian will connect you with a partner that he knows will be able to serve you best and get you the coverage you need!

INSURANCE IAN

Protect those who matter

We would all do anything for our loved ones, and now Ian makes it easier than ever to get Life Insurance that protects your family financially.

INSURANCE IAN

Protect those who matter

We would all do anything for our loved ones, and now Ian makes it easier than ever to get Life Insurance that protects your family financially.

How can an ESOP help me maximize the value of my company when I retire?

An Employee Stock Ownership Plan (ESOP) allows you to sell your shares at fair market value directly to your employees. This often results in a competitive sale price while providing tax advantages that can enhance your net proceeds. By creating a built-in buyer for your business, an ESOP ensures you receive the best value for your life’s work.

Will implementing an ESOP facilitate a smooth succession plan?

Yes, an ESOP provides a structured approach to succession by gradually transferring ownership to your employees. This ensures business continuity, retains experienced staff, and maintains the company culture you’ve built, all while allowing you to step back on your own terms.

How does an ESOP contribute to my legacy as a business owner?

There is no one-size-fits-all answer. The amount of insurance you will need is a highly personal decision. A life insurance agent will look at your assets, debts, personal situation, financial goals and your family’s needs so they can make recommendations tailored to you. Remember, your needs might change throughout your life, so it’s a good idea to review your policy at milestone events such as getting married or having a baby.

Why do people get life insurance?

Life insurance is a way to make sure that your family and dependants don’t suffer financially when you die. Life insurance can be used to pay for a funeral, pay off debts (including your mortgage), pay for your children’s education and help your family maintain their standard of living when they no longer have you to support them.

When do I need life insurance?

if you’re planning on getting married, having kids, or buying a home, you should probably start to think about it. You will want to make sure that your family is provided for, and can pay off your debts after you’re gone. Getting life insurance while you are young and healthy can result in lower premiums, as you pose a significantly lower risk.

Does my age effect my

cost?

Yes, your age can affect your premiums. Your insurance company is going to evaluate the risk that you pose to the company and place you in a ‘risk grouping’. Usually, the younger you are, the healthier you are, the lower the risk you pose, the lower the premiums that you have to pay. Keep in mind that age is only one factor, and the insurer will also look at things like your gender, medical history, physical condition and if you smoke.

How much do I need?

There is no one-size-fits-all answer. The amount of insurance you will need is a highly personal decision. A life insurance agent will look at your assets, debts, personal situation, financial goals and your family’s needs so they can make recommendations tailored to you. Remember, your needs might change throughout your life, so it’s a good idea to review your policy at milestone events such as getting married or having a baby.

Why do people get life insurance?

Life insurance is a way to make sure that your family and dependants don’t suffer financially when you die. Life insurance can be used to pay for a funeral, pay off debts (including your mortgage), pay for your children’s education and help your family maintain their standard of living when they no longer have you to support them.

Get Started Today

It’s simpler than you think!

ESOP Help simplifies your company’s transition to employee ownership through tailored Employee Stock Ownership Plans.

Contact

Ian helps people find the best life insurance policy for their situation.